5 Key Trends Driving Supplier Management and Due Diligence

Can you afford to take the risk? We assess the key drivers behind increasing supplier management and due diligence activities in supply chains.

This article was first published on Greenstone.

First, we would like to take the opportunity to thank the Procurious members who took part in this survey. Your input is very much appreciated.

In the current non-financial reporting landscape there is a heightened focus on understanding your supply chain. As a result, organisations are increasingly evaluating the performance of their suppliers against a wide spectrum of non-financial criteria and monitoring the associated risks.

In order to better understand what is driving this behaviour and how companies are identifying and mitigating supply chain risk, Greenstone conducted the ‘State of Supplier Management 2016‘ survey.

We asked 1000 senior decision makers from mid-to-large organisations about the perception of supply chain risk and due diligence at their organisation. We also asked about the drivers for collecting supplier information and key factors in shaping their supplier engagement programmes.

We have identified five key insights into the state of supplier management from this study. These are listed below and expanded on in this report.

- Supplier due diligence processes are a growing requirement for most businesses.

- The majority of businesses are collecting non-financial information from their suppliers at some level.

- Regulation and reputational risk are the strongest drivers for collecting supplier information and help to shape supplier engagement programmes.

- Procurement teams are much more likely to be responsible for the collection of supplier data than Sustainability teams.

- There is a growing trend of companies adopting online solutions to gather and analyse supplier management data.

Supplier Due Diligence

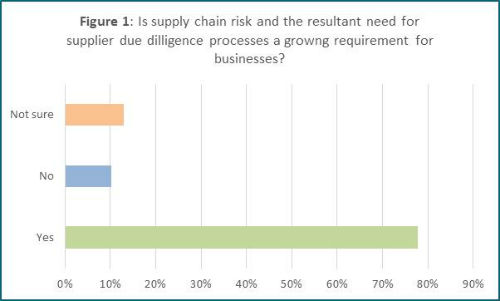

As you might expect, given the increasing global focus on supply chains, more than three quarters of respondents see supply chain risk, and the resultant need for supplier management and due diligence processes, as a growing requirement in their business.

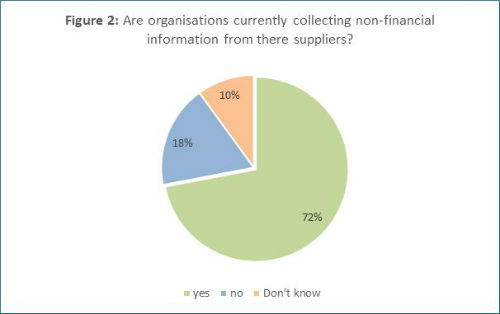

In line with this perception, 72 per cent of responding companies are already trying to address supply chain risk by collecting non-financial information from their suppliers.

Data Collection

The necessity to collect non-financial information from suppliers appears to have become accepted across multiple sectors. However, the level of detail, method, and frequency of data collection differs greatly.

It was found that 43 per cent of respondents only collect supplier information as part of a tender process, or in the initial stages of supplier contracting. Therefore, these organisations are not conducting ongoing supplier due diligence. They cannot be sure that suppliers remain compliant throughout the period in which they deliver services.

However, a similar number of organisations do keep track of ongoing supplier performance. 17 per cent are sending out questionnaires by email or post, and 22 per cent are using an online supplier management tool.

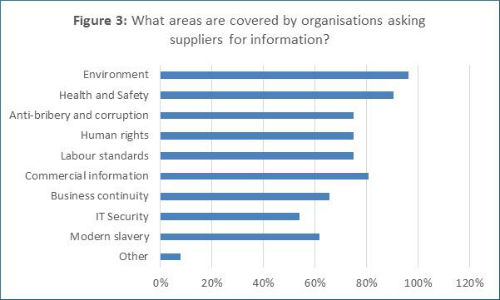

Where supplier information is being gathered, there are common topic areas of compliance focus. Environment, health and safety and commercial information (e.g. insurance certification etc.) are the top three areas covered in supplier questionnaires.

However, what the study also shows is that a wide range of information is being requested. As a result, increasingly diverse areas of both the buyer and supplier organisations are required to engage in the process and have access to the data.

Drivers for Supplier Engagement

The research demonstrated that non-financial supplier risk and compliance have become key topics for organisations but what is driving this shift in behaviour?

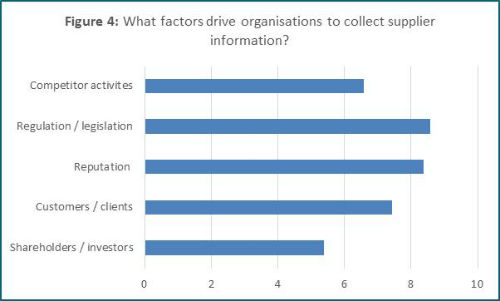

When asked which factors are driving the collection of supplier information, 43 per cent of all respondents point to regulation and legislation being the strongest motivating force, followed closely by reputational concerns (32 per cent).

When asked what factors were important in shaping the structure and focus of organisations’ supplier engagement programmes, risk reduction, corporate sustainability, reputational risk and regulation were all sighted as significant motivating forces.

Specific legislative and reporting framework drivers mentioned by respondents included: Bribery Act, the UK Modern Slavery Act, UN Global Compact and ILO Core labour Standards as the top four frameworks or guidelines used to inform their supply chain practices and reporting processes.

Responsibility for Supplier Risk and Compliance

While non-financial reporting has long been the responsibility of CSR or sustainability teams, the increasing momentum of supply chain reporting is engaging new areas of organisation.

This is partly due to the outward looking nature of this issue and the need to engage with multiple supplier organisations. It is also due to the breadth of topics covered by the requests for information.

The study shows 83 per cent of respondents stated that procurement is the area that manages the entire process, from contacting suppliers, through to analysis of the data.

This is most likely due to the fact that procurement ‘own’ the relationships with the suppliers, have a clear idea of contract status and the commercial scale of the contracts and can therefore identify which suppliers meet the buyers defined risk and compliance criteria.

The level of resource allocated to supplier programmes varied significantly with 40 per cent saying that managing this process was the part-time responsibility of a full time employee and 38 per cent saying that multiple individuals in the business have full time responsibility.

What this does show is that there are clearly defined responsibilities within organisations for identifying third party risk and dealing with non-compliance.

Moving Beyond Manual Processes

The complexity and scope of collecting, analysing and reporting supplier information often calls for solutions beyond the manual processes and repository functions of lifeless spreadsheets.

For those organisations that have not yet automated the process, 61 per cent say they are considering adopting an online solution to gather and analyse supplier information.

It is evident organisations recognise the need for automation in the process, as it is not feasible to manually evaluate hundreds or thousands of supplier responses, and monitor their ongoing compliance.

In addition, the increasing legislative and reporting requirements place an additional emphasis on transparency and audit capabilities.

For more on the ‘State of Supplier Management 2016‘, visit the Greenstone website.

Greenstone’s SupplierPortal solution enables buyers to effectively manage supplier risk and compliance through a secure and private online platform. Buyers have the flexibility to distribute standard framework questionnaires, as well as proprietary questionnaires, to their suppliers and can then manage and analyse this information through a comprehensive suite of analytical tools.