Making the Final Ascent from CPO to CEO

Taking the final step from CPO to CEO appears to elude many procurement leaders. So, why does Procurement so often lose out to Finance?

At the eWorld procurement conference last month Tania Seary interviewed me about leadership as part of Procurious’ Career Boot Camp series. After we finished she said, “there’s one question we ran out of time for: why do so few CPOs become CEOs?”

This set me thinking on my flight home. There are well known examples of the supply chain providing the key to the executive washroom. Tim Cook at Apple, and Sam Walsh at Rio Tinto are just two of the more well-known.

Famously, though, the best trodden route to the top is via the Finance function. 52 per cent of FTSE100 CEOs and 30 per cent of Fortune 500 CEOs have a financial background. So why do the accountants win out?

Show Me the Money!

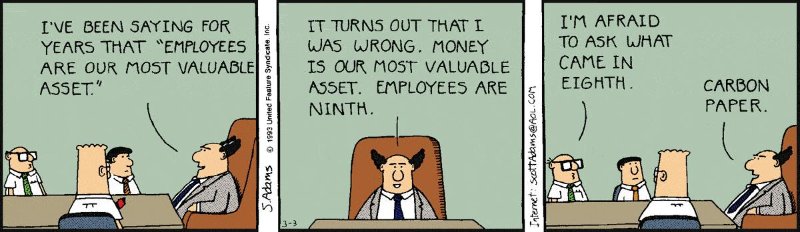

There’s a Dilbert cartoon where the boss informs his staff: “you know we said ‘people are our most valuable asset? Turns out we were wrong. Money is our most valuable asset.”

Courtesy of Scott Adams (dilbert.com)

Courtesy of Scott Adams (dilbert.com)

Given the paucity of HR directors making it to the hot seat, it seems boards tend to agree. CPOs should score well here: at the core of the role, after all, is to maximise the effectiveness of the company’s expenditure.

“Much travell’d in the realms of Gold”

Peter Smith’s eWorld workshop inspired me to quote Shelley, so it may be time to turn to Keats.

The other great advantage possessed by Finance Directors is that they see the entirety of the organisation: from wide expanses to western islands, no corner is hidden from their view nor beyond their reach.

This is critical. The board relies on the FD as one of the few people, other than the CEO, who has a grasp on how the totality of the business fits together. Not only does she or he have knowledge of what’s going on in each part, but they also appreciate the interlinkages between them.

How do CPOs fare against this measure? Well, if we’re frank, variably. In some organisations, CPOs see the complete cost base and fully understand how the company’s capital is deployed – and why.

In others, they may only influence part of applicable spend – KPMG’s survey suggested the average is around 60 per cent. Without that comprehensive view, the nominations committee may not consider a candidate ready to take overall leadership.

I suspect this is the most critical factor holding CPOs back. Ascending to greater height affords – but may also in the corporate world, require – a broader view.

Then like stout Cortez, with eagle eyes, may the CPO take that final step to become a CEO, and survey the scene, silent, on a peak in Darien.

To hear more from Stuart, catch up with his Career Boot Camp podcast here. You can also read more from Stuart on the impact of maverick purchasing on procurement, and download the latest Applegate whitepaper on the subject.