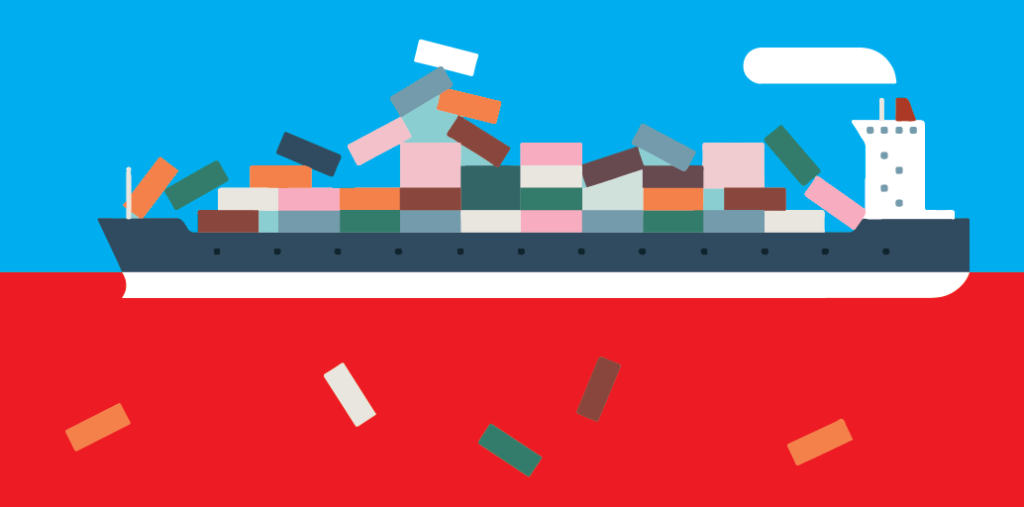

Supply Chain Trouble Off the Starboard Bow

As attacks on ships in the Red Sea continue unabated, UK and European businesses are feeling the pinch once again in their supply chains.

When Iranian-backed Yemeni Houthi rebels began attacking cargo ships sailing through the Bab el-Mandeb strait at the southern end of the Red Sea, there was little sense of what was to come in the region over the course of the following 4 months. Using a combination of drones and missiles, the rebels attacked around 40 more ships, even attempting to board other merchant vessels.

The attacks have culminated in the recent sinking of a cargo ship, the Rubymar, in spite of a concerted effort of retaliatory action from global military forces. The Rubymar’s cargo of fertilisers now also poses an ecological threat to the Red Sea, and the global community has been left pondering its next course of action.

This shipping route is one of the busiest in the world and is no stranger to piracy and attacks on vessels. Between 2000 and 2012, peaking between 2006 and 2009, Somali pirates attacked numerous vessels off the East Coast of Africa. Attacks were eventually reduced with prolonged naval presence in the region, although there are concerns that the pirates are returning as attention is diverted to the Red Sea.

What Makes the Red Sea so Critical?

If we are talking about the criticality of the Red Sea and the Suez Canal for global shipping and supply chains, you don’t have to look any further than the disruption caused when the cargo ship, the Ever Given, ran aground in this very stretch of water. The cost of the complete closure of the route for 6 days ran to an estimated $9 billion per day, and that doesn’t even account for the resulting backlog in shipping traffic.

Traffic passing through the Red Sea has only increased in recent years. An average of 59 ships per day used the route in 2023 (an estimated total of over 21,000 ships in the year), accounting for 12 percent of global trade and 30 percent of global container traffic.

The route is by far the quickest way for goods being imported into Europe from Asia to be transported. Organisations across a variety of industries, including construction, manufacturing, automotive and even FMCG, must account for the route in their logistical planning, a task that has become much more challenging in recent months.

Longer Trips Make for Operational Disruption

Shortly after attacks began, some shipping companies opted to start rerouting some of their ships and tankers around the Cape of Good Hope at the Southern tip of Africa. This percentage has increased as the frequency of attacks has climbed, with some estimates stating that container traffic through the Red Sea has decreased by approximately 78 percent against expected levels since the beginning of 2024.

This route change has had a massive impact on supply chains, as goods are taking considerably longer to make their journeys. On average, a ship travelling between Singapore and Rotterdam has to travel an additional 4000 nautical miles, taking approximately 10 days longer to make their journeys.

Other routes between Asia and Europe or North America can see even longer delays, with journeys taking 2 or 3 times longer than normal. Although companies are now actively planning for disruption now, there are still considerable knock-on effects for manufacturing in European-based factories.

Automotive giants Tesla, in Germany, and Volvo, in Belgium, were forced to pause production earlier this year due to material and product shortages, some retailers problems around Valentine’s and Mother’s Day due to lower than expected stock levels, in particular relating to non-food items being imported from Asia.

Consumer Costs to Rise – But By How Much?

In addition to the disruption to supply chains, companies are also having to contend with rising costs for freight and shipping. Container prices trebled, and even quadrupled, towards the end of the year compared to those in early November, with companies continuing to bear this burden well into the new year.

As well as this, costs for shipping insurance have also increased markedly across the board, though undeniably the highest rise has been seen for vessels still being routed via the Red Sea. Rates are being revealed as between 0.6 and 1.0 percent of a ship’s value (often around 0.5 percent). For larger vessels, this cost can be well in excess of 100 million Euros.

Although industry experts predict that these rates will begin to drop in the next few months, there is still likely to be an impact on oil and gas prices, with many companies being left in a position of deciding how much of this cost to pass on to consumers. It’s a perfect storm that shows no sign of abating, but may give Procurement and Supply Chain professionals yet another opportunity to bring their skills to bear and provide a more positive outcome.